On the third day after launching Ethereum spot ETFs, outflows reached about $179 million (Rp2.9 trillion) by July 25, 2024.

Grayscale’s Ethereum ETF (ETHE) saw a significant drop, with a net outflow of $346 million on the third trading day, reducing its assets under management from over $9 billion to $7.4 billion.

However, not all Ethereum ETFs performed poorly. BlackRock’s iShares Ethereum Trust (ETHA) attracted $71 million in inflows on the third trading day, showing strong investor interest.

Other ETFs like Fidelity’s Ethereum Fund (FETH), Bitwise’s Ethereum ETF (ETHW), VanEck’s Ethereum ETF (ETHV), and Invesco/Galaxy’s Ethereum ETF (QETH) also reported inflows, reflecting diverse investor interest.

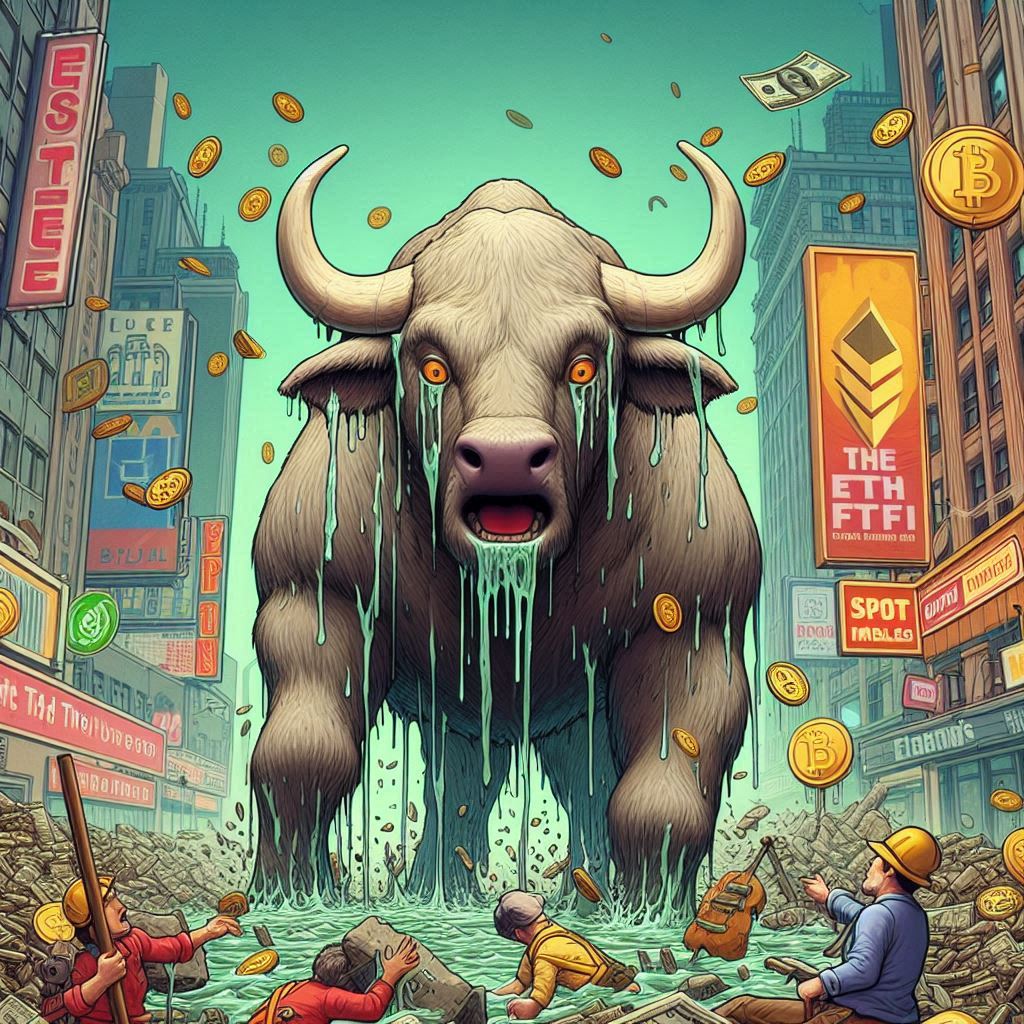

Spot ETH ETFs Trigger “Sell the News” in Crypto Markets

Meanwhile, ETH prices have dropped over 10% since the ETF approvals, trading at $3,251 at the time of writing.

This decline suggests strong selling pressure, similar to the pattern seen with Bitcoin ETFs, where prices corrected after an initial rise, indicating a “sell the news” trend in the crypto markets.

Large investors, or whales, also contributed to the price drop. Grayscale recently moved 140,044 ETH to Coinbase Prime, worth nearly $500 million, impacting market prices.

Conversely, BlackRock’s iShares Ethereum ETF added 76,669 ETH to its portfolio, worth about $262 million, taking advantage of the lower prices.

With the current market volatility, the future of Ethereum ETFs remains uncertain. Investors should be prepared for fluctuations and evaluate if this price drop is a temporary correction or a sign of a deeper trend in the crypto market.

More Crypto News: https://blog.dinodapps.com/